BigCommerce is known not only for its gorgeous themes but also for its brilliant developers and specialists that can help you set up your customers’ next favorite spot swiftly. Another benefit is the 65 BigCommerce payment channels available to consumers.

In today’s article, we’ll look at the definition of BigCommerce payment gateways, how they function, and other relevant information.

What are BigCommerce Payment Gateways?

Payment gateways are used by most websites and online retailers that accept various payment methods such as PayPal, Visa, MasterCard, and so on.

Payment gateways for BigCommerce are similar. Store operators utilize them to gather and handle online purchases. Consumers may pay their bills using a variety of payment methods thanks to a single payment gateway.

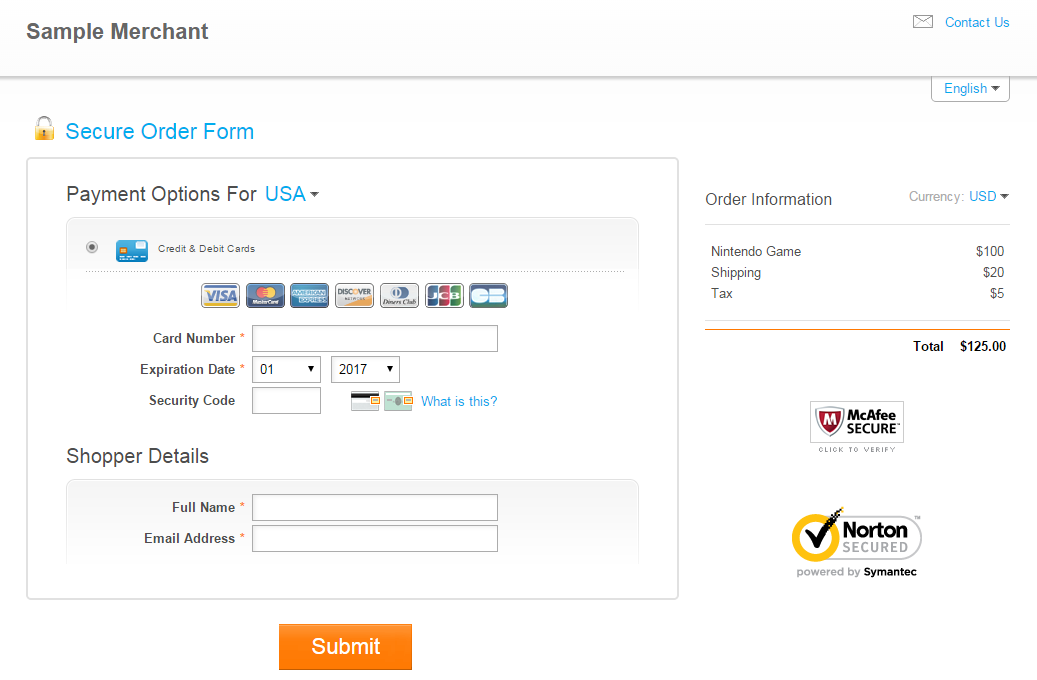

A Merchant Service Provider, as seen in this BigCommerce illustration, operates as a middleman between your BigCommerce business and other credit card banks and corporations. You’ll be able to use BigCommerce payment gateways with it.

The following are some of the benefits of using BigCommerce payment gateways:

- It interacts with your online business and assists you in processing customer payment information.

- Payment gateways for BigCommerce convert consumer input into codes, which are then securely sent.

- BigCommerce payment gateways will immediately notify shop owners whether their transaction is accepted or denied for any reason. This allows you to direct the client to a validation page or persuade him to try another payment method.

>>> Read more : Bigcommerce pricing: Review and which plan is suitable for your ecommerce store 2022

Types of BigCommerce Payment Gateways

Payment gateways for BigCommerce are separated into three groups based on how they work and are used:

1. Hosted payment

When a consumer decides to check out, these hosted payment gateways, also known as “Redirects,” will instantly redirect them to a new page called Payment Service Provider (PSP), where they may finish the transaction, including processing and selecting a payment method.

The most prominent example of this type is PayPal.

On the one hand, they provide PCI-compliant payments as well as consumer fraud prevention, ensuring that the customer’s information is safe. Furthermore, consumers are more comfortable with this kind of payment, and business owners may modify payment gateways more easily.

However, because redirects are external, you may encounter a number of issues while monitoring your visitors’ experiences.

2. Transactions are handled on-site

Large-scale enterprises frequently accept on-site payments. Everything is done on your own computers, from checking out to processing client payments. This feature enables large corporations to get control of their consumers’ data in order to provide better services in the future.

On the other hand, owners must be accountable for their security because they have complete control over their customers’ demographics. When information is exposed, it becomes synonymous with your company’s collapse.

If you’re interested in using this form of BigCommerce payment gateway, you should be aware of your options and responsibilities.

3. On-site checkout with off-site payments

Stripe, one of the most well-known sites, uses this form of BigCommerce payment gateway.

In general, consumers will be sent to a payment gateway website to fill out their contact and payment information. The URL of your online store will display when the form has been properly constructed, along with payment notification data.

Stripe handles its customers’ payments in the same way. However, there are two sides to every coin: pros and cons.

Its simplicity attracts more clients and may boost your online store’s conversion rate. Many customers have given up on purchasing a product because the payment process is too difficult and time-consuming. Furthermore, whereas on-site payment gateways are ideal for businesses that handle a high volume of orders on a regular basis, this gateway was designed specifically for small businesses. Its simple setup feature will be a plus for your company.

On the other hand, you should monitor your customer’s experience more regularly. Because it’s possible that utilizing this type will cause problems.

How BigCommerce payment gateways work?

Now that you know what a payment gateway is and what sorts of payment gateways exist, let’s look at how BigCommerce payment gateways function.

When a consumer clicks the purchase now button, the payment process begins. After that, he’ll be sent to the checkout page, where he’ll have to input his credit card information. He’ll next proceed to a secure website to complete the purchase.

BigCommerce payment processing

During a transaction, the BigCommerce payment gateway performs the following actions in just a few seconds:

- Allows you to process the customer’s payment data by integrating with your store.

- All payment information is securely encrypted and sent.

- If the system accepts or refuses the payment to your shop, it redirects the buyer to a confirmation page or recommends them to try another payment option.

How to add Payment gateway to BigCommerce store?

- Visit Store Setup to discover the payment gateways that BigCommerce offers.

- Choose Payments

- Select Online Payment Methods from the drop-down menu.

- Click Set up when you’ve found your desired gateway. Then you’ll be sent straight to the setup page for the BigCommerce payment gateway. A list of required credentials will appear. To access it, you must first log into or contact your payment gateway.

- Click Save once you’ve completed inputting your authorisation and preferences.

The payment gateway for BigCommerce is currently active. Try placing a test order to observe how your clients react to this.

Additional settings

Although the setup of BigCommerce payment gateways differs differently, they all contain the same settings:

- Display Name – when your customers check out, they will see the payment option by its display name.

- Duplicate window – This feature allows an identical order to be received without being flagged as a duplicate and removed quickly.

- You can execute a transaction without charging your card in Test mode, but we recommend that you only use Live or Production to avoid losing money on actual transactions.

The payment gateways will show alphabetically on your checkout page, regardless of the Display Name, in order of type (offline, online, digital wallet). On the cart page, some payment methods, such as PayPal and PayPal powered by Braintree, will display a button.

How to secure your BigCommerce payment gateways?

BigCommerce’s payment gateway has long struggled with security issues. These payment method providers must ensure that their users’ information is kept safe and that money is transmitted safely.

When it comes to preserving data about their customers, retailers have a responsibility as well. Nobody wants their personal information or money to be stolen by strangers or hackers. So, how can store owners keep their BigCommerce payment gateways safe?

First and foremost, we will discuss two types of probable fraud that you may encounter on eCommerce platforms:

- Unauthorized purchases: Most online retailers will allow clients to keep their credit card details and other personal information for one-time use only. However, this step may allow criminals to gain access to the user’s login details and make payments in the name of their customer.

- Identity theft: after obtaining your customer’s personal information and payment details, a fraudster may easily enter into their account and make transactions.

These are by far the top five methods we offer for swiftly detecting fraud and improving customer experiences.

1. Utilize AVS

The Address Verification System (AVS), will match the billing address claimed for a credit card with the information kept in the customer’s register by the credit card’s issuing business. Despite the fact that most BigCommerce payment gateways have already integrated this tool, store owners should still seek and double-check the data.

2. Keep track of your transactions and keep an eye out for red flags

A lot of strange behaviors point to possible theft. Has the customer made a last-minute change to their shipment information? Are they purchasing a thing from your business using a bizarre device that isn’t normal? Fraud protection software will assist you in swiftly identifying these patterns and issuing alerts to your clients.

Checking your payments on a regular basis will help you uncover undesired scams and minimize the harm they can bring to your organization.

3. Restrict expenditures

When a scammer uses someone else’s credit card, they tend to use it as often as possible until the card is detected and canceled. As a result, you should recommend setting a limit on how much a customer may spend on your store in a day. It will take time to avoid fraud even with the use of fraud detection devices – a spending cap decreases risk.

4. Require the CVV code

The CVV code is a 3-4 digit code found on the back of credit cards. To comply with PCI, online sellers are not authorized to hold CVV numbers. This means that the buyer must pay using an actual credit card from your store. It’s pointless not to require the CVV code because it’s one of the most powerful fraud-prevention tools accessible.

5. Strong passwords are needed

Besides email phishing, a scammer may employ password cracking tools to get access to one of the consumers’ accounts. Before stumbling across the suspect’s password, this application systematically attempts different character combinations. A simple password is easy to crack. Your store is better if you require passwords with unique letters and digits.

7 most popular BigCommerce payment gateways

So you’re still uncertain about which payment gateway is best for your BigCommerce store. We’ve identified the 7 top BigCommerce payment gateways on the market based on their services, usage, functionality, and security system:

1. Amazon Pay

Amazon first made this hosted payment gateway available in 2007. It lets customers fill out payment information on the provider’s website rather than yours. When the payment procedure is completed, they will be routed back to the shopping site.

The underlying advantage of this is that it allows users to keep both their delivery and purchase information in one place. Amazon Pay will rapidly transfer payment and shipping information into the website customers are using when they check in with their account. This tool saves time not only for consumers but also for store owners.

AmazonPay is one of the most well-known payment gateways for BigCommerce. It does not charge you a startup fee, a fraud protection fee, or even need you to sign a contract. This is the payment gateway for you if you want to save both time and money.

On domestic payments, AmazonPay charges its customers 2.9% plus $0.30 for each transaction. You will be charged 3.9% if you wish to transfer money to another nation.

2. PayPal

If you’ve ever made an online purchase, you’ve almost certainly heard of PayPal. It refers to the BigCommerce payment gateways’ redirect kind, which we discussed before. A big number of entrepreneurs and BigCommerce business owners like it because of the features it offers.

PayPal was one of the first payment systems to provide a quick and secure way to charge and trade money over the Internet without the need for a credit card. It’s also difficult to overlook the ease of use and convenience of setting up a single system.

PayPal, like AmazonPay, does not charge an extra fee for fraud protection measures. Furthermore, you will be given two options: you may utilize PayPal’s checkout payment service for free, or you can pay $25 per month for greater checkout customization capability.

The cost charged by PayPal is similar to that charged by AmazonPay. Their processing fee is 2.9 percent plus $0.30 for every transaction.

3. Stripe

As a rising star, Stripe support more than 22 nations across the world. Stripe is one of the most popular BigCommerce payment gateways, especially among developers and eCommerce business owners, due to its reasonable price.

Stripe’s primary advantage is that it’s ideal for non-technical customers, with simple API interfaces for every major eCommerce site. Furthermore, they are continually developing and adding new features, such as Bitcoin transfers and WeChat Pay beta tests.

All of these advancements will enable internet merchants to extend their market by utilizing cutting-edge technologies. Its payment processing costs are identical to PayPal’s.

4. Square

Are you a small company owner? And, for your online business, are you looking for the finest BigCommerce payment gateway? Then Square is the ideal choice for you.

Square is a credit card processing system that also serves as a payment gateway for credit card swipers that are connected to your smartphone. You no longer have to worry about if your customers want to pay with their credit cards by physically swiping them.

You will be charged 2.75 percent as a processing fee if you use Square for credit card swipe payments. And if you’re just doing regular transactions, it may cost you up to 3.5 percent plus $0.15.

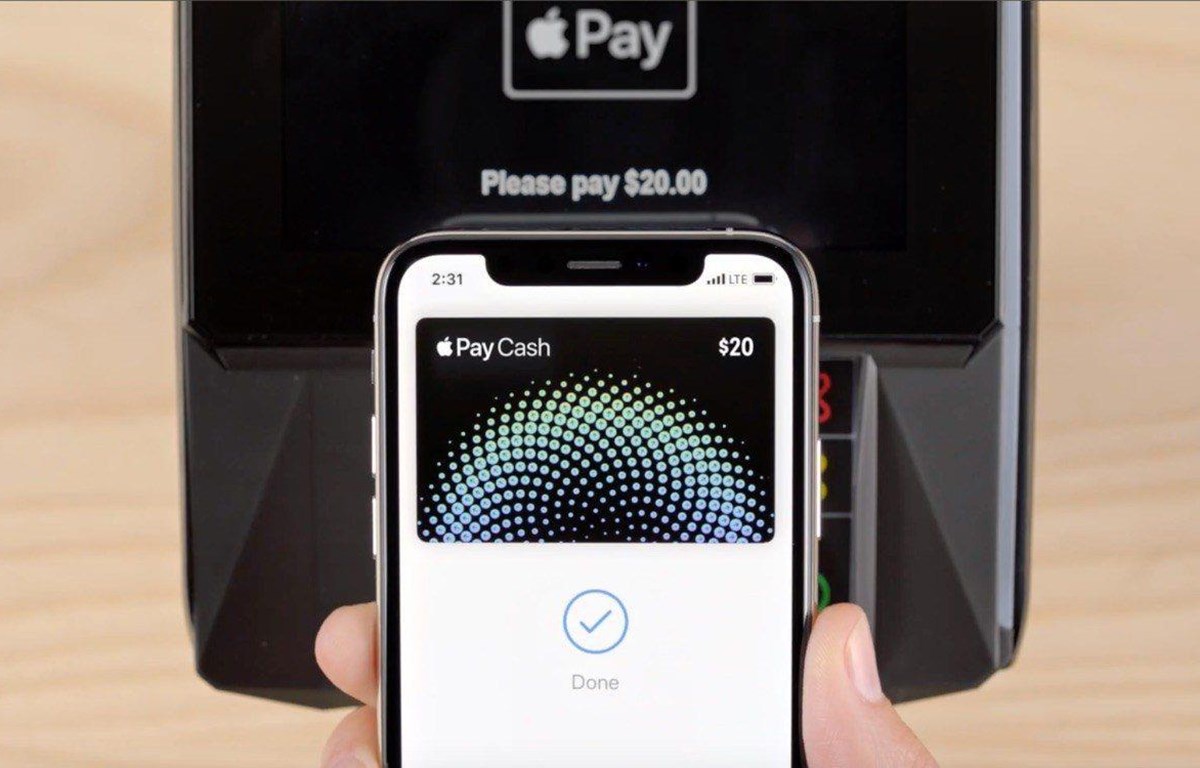

5. Apple Pay

Customers currently prefer using Touch ID or Face ID to complete payments because of its convenience and quickness. As a result, offering these two services may be advantageous to eCommerce enterprises. Apple Pay is one of the most popular BigCommerce payment gateways because of its mobile-payment capabilities. Customers who prefer to retain an electronic wallet to accommodate their purchases receive the most attention. Using these services, shops could take payments from 383 million iPhones throughout the world, with Apple Pay accounting for around 43% of all iPhone users.

Apple Pay compels consumers to spend 3% of their transaction fees without making any extra purchases.

6. Authorize.net

With over 25 years of expertise in transaction processing, Authorize.net obviously understands what they’re doing and how to provide the finest service to their consumers.

It is compatible with a variety of large eCommerce sites and includes free features such as fraud detection, monthly payments, and speedy checkout. The most crucial feature is that it enables business owners to accept payments via a number of payment methods, including PayPal, Apple Pay, and credit cards.

Authorize.Net offers a payment portal-only package so you don’t have to alter anything on your website when your company is large enough to pick a merchant account through your bank to earn acceptable payments. You will, however, be required to pay a modest fee to have access to this unique function.

Until now, Authorize.net has requested that you pay 2.9 percent in processing costs. You will have to pay an extra $0.30 per transaction if you wish to utilize other payment providers.

7. Braintree

Despite the fact that Braintree was purchased by PayPal, they managed to keep their low prices and establish themselves as one of the most important BigCommerce payment gateways.

Braintree accepts nearly all alternative payment methods, including PayPal, ApplePay, Android Pay, and even Bitcoin via Coinbase. This advancement will help Braintree users to expand their consumer base, particularly those who are interested in using one of the aforementioned payment methods.

For domestic payments, Braintree charges the same rate as PayPal. Meanwhile, if the payments are international, sellers will have to pay an extra 1%.

Increase your conversion rate with us

The online payment processing system would not be completed without a payment gateway. If you know the entire picture of BigCommerce payment gateways given above, particularly how BigCommerce payment gateways function, you will be able to run your BigCommerce business more effortlessly.

Nothing will be able to stop you from earning more sales if you choose the finest BigCommerce payment gateways for your business. Magesolution, as one of the leading eCommerce development and solutions companies in Vietnam, proudly introduce our Bigcommerce development services. Having helped numerous businesses in all fields, you can totally believe us and expect significantly increased conversion rate in the near future. Don’t hesitate to TALK TO US right now!